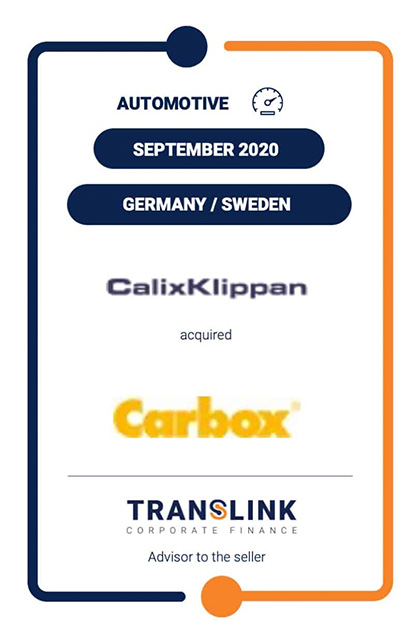

Automotive

With roughly 400 transactions taking place every year, the M&A activity in the automotive sector is dynamic. We are continuously talking to buyers and sellers and as such know the principal drivers in the sector.

Auto manufacturers are global and seek global suppliers. Auto components suppliers are constantly looking for targets to increase their geographical coverage and offer platforms on each continent. Our clients turn to us for advice because of our extensive footprint and comprehensive understanding of local and global markets.

Denmark

Denmark Finland

Finland France

France Germany

Germany Italy

Italy Norway

Norway Poland

Poland Spain

Spain Turkey

Turkey United Kingdom

United Kingdom USA

USA Brazil

Brazil Israel

Israel China

China India

India Singapore

Singapore