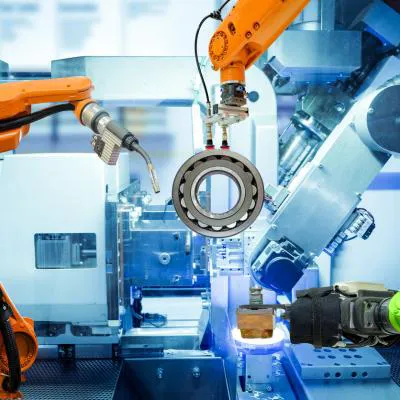

Translink Corporate Finance in the United Kingdom acted as the lead advisor to Doncaster-based Nationwide Bearing Company (NWB) on its sale to South African listed company Invicta Holdings Limited, alongside Clarion Solicitors, who acted on the deal as legal advisors to the director shareholder.

Posts

Translink Corporate Finance South Africa acted as the financial advisor to Woolworths Holdings Limited in its proposed acquisition of 93.45% of the shares in Absolute Pets from Sanlam Private Equity Mid-Market Fund I and Absolute Pets management.

NUtec is regarded as one of the leading digital ink developers and manufacturers of UV curable, water based and solvent based products. Based in Cape Town South Africa, this well-established business, develops and manufactures high demand industrial products for global distribution into some 100 countries.

Translink Corporate Finance announces the sale by Energipole of a majority stake in Dolphin Coast Landfill Management (“DCLM”), the largest high hazardous waste operation in the Southern hemisphere, to Veolia. The site is located in KwaDukuza, South Africa.

Translink Corporate Finance announces the acquisition of 100% of Oro Agri SEZC Ltd by Omnia Group Holdings Ltd for an aggregate consideration of USD 100 million. Translink acted as sole transaction advisor to Omnia.

In a significant move to expand their distribution offering, Adcock Ingram Healthcare (Pty) Ltd, has acquired Virtual Logistics (Pty) Ltd, a national and cross border fine distribution company. Translink acted as advisor to the buyer. The acquisition will be effective April 2017.

Adcock Ingram Holdings Ltd is a leading South African pharmaceutical manufacturer, listed on the Johannesburg Stock Exchange.

Translink Corporate Finance announces the acquisition of Metal Concentrators (Pty) Ltd, the second largest South African refiner of precious metals, by Caxal Enterprises (Pty) Ltd, the investment holding vehicle for the Crosse family. Translink acted as the exclusive financial adviser for Caxal Enterprises.